putnam county property tax rate

40 Gleneida Ave Room 104 Carmel NY 10512. Mumpower State Capitol Nashville TN 37243-9034 6157412775 To Report Fraud Waste Abuse.

Putnam County Ny Property Tax Search And Records Propertyshark

Other taxes collected by the County Treasurer are Manufactured Home Inheritance and Special Assessments.

. Comptroller of the Treasury Jason E. 2019-2020 School Tax Rates Revised. Installment payments are made in June September December and March.

The accuracy of the information provided on this website is not guaranteed for legal purposes. 25 residentialfarm 30 business personal property and 40 commercial. Total tax rate Property tax.

One Family Dwelling on a Platted Lot. All online payment transactions are final and cannot be reversed. Map Group Parcel Special Interest Subdivision Block Lot SHOW ONLY UNPAID.

One Family Dwelling on a Platted Lot. Real Property Tax Service Agency Putnam County New York. Find All The Record Information You Need Here.

Taxes must be paid by 10-24-16 to avoid newspaper. The median property tax also known as real estate tax in Putnam County is 81300 per year based on a median home value of 10930000 and a median effective property tax rate of 074 of property value. The Putnam County Indiana Treasurers Office is responsible for the collection and management of county taxes as well as other financial duties.

Learn all about Putnam County real estate tax. Submit a report online here or call the toll-free hotline at 18002325454. Official Putnam County Illinois website features interactive maps for economic development government minutes agendas county departments.

Customers wishing to pay their taxes by installment must fill out APPLICATION and submit it to the tax collectors office by April 30 th of the year they wish to begin making installment payments. In Florida Property Appraisers are independent constitutional officers duly elected from their counties of residence by their fellow citizens and. Ad Property Taxes Info.

Putnam Country Tax Assessors Office Website. Property tax information last updated. Putnam County Property Appraiser.

Putnam County Online 2005 - 2022. A valuable alternative data source to the Putnam County IN Property Assessor. Access Indiana Indiana Business Research Center Out of State Sex Predator Locator State Government Phone Numbers State Government.

Property taxes are regularly paid beforehand for an entire year of possession. Business owners need to file their Tangible Personal Property Return form DR-405 with the Property Appraisers Office. 2020-2021 School Tax Rates.

The median property tax also known as real estate tax in Putnam County is 733100 per year based on a median home value of 41810000 and a median effective property tax rate of 175 of property value. Welcome to the Putnam County Sheriffs Department. The 2021 county tax rate is 2472 10000 2472 assessed value.

The Putnam County Assessor mails a personal property declaration form to each individual and. 001 - Hennepin Senachwine Multi-Township Assessor 005 - Unit School District 005 115 - Grade School District 115 500 - High School District 500 513 - Junior College 513 535 - Unit School District 535 C001 - Putnam County GHMF - Granville - Hennepin Fire. TFD - Tiskilwa Fire District.

Putnam County property owners have the option to pay their taxes quarterly. Our office only collects county taxes and does NOT collect city taxes. Putnam County Sheriffs Tax Office 236 Courthouse Drive Suite 8 Winfield WV 25213 304 586-0204.

What is the Putnam County tax rate. Changes occur daily to the content. When buying a house ownership is transferred from the seller to the purchaser.

Exemptions applications for Real Property should be filed with the Property Appraisers Office. 2021-2022 School Tax Rates. Information about your taxes.

Instead contact this office by phone or in writing. 2 discount applies to current real property and tangible personal property tax payments postmarked on or before January 31st. Putnam County Property Tax Facts.

Get free info about property tax appraised values tax exemptions and more. Who sets the county tax rate and when. 304 586-0204 with tax questions.

View an Example Taxcard View all search methods. Does the Putnam County Trustees Office collect city taxes. The assessment value divided by 10000 and multiplied by the tax rate will give you the amount that should appear on your tax notice from the Putnam County Trustees Office.

We hope you find this information and the resources provided helpful. 245 East Main Street Ottawa Ohio 45875. 100 South Jefferson Avenue Suite 207 Eatonton GA 31024 706-485-5441 Fax 706-485-2527 Pamela K.

The Putnam County Commission sets the tax rate it is usually set in July. You may begin by choosing a search method below. T04R - Magnolia Township R B.

The most common and largest dollar amount collected in taxes come from Real Estate. Click above to pay your Putnam County Property Taxes. Then who pays property taxes at closing if buying a house in Putnam County.

To obtain the most current information please contact the Putnam County Tax Collectors office. Unsure Of The Value Of Your Property. TIF01 - Granville TIF.

Whether you are already a resident or just considering moving to Putnam County to live or invest in real estate estimate local property tax rates and learn how real estate tax works. Assessment value is a percentage of the market value. Below is more detailed information regarding taxes.

Haves And Have Nots County Property Taxes Provided 2 5 Billion In Local Health And Social Service Funding But It Was Unevenly Distributed The Center For Community Solutions

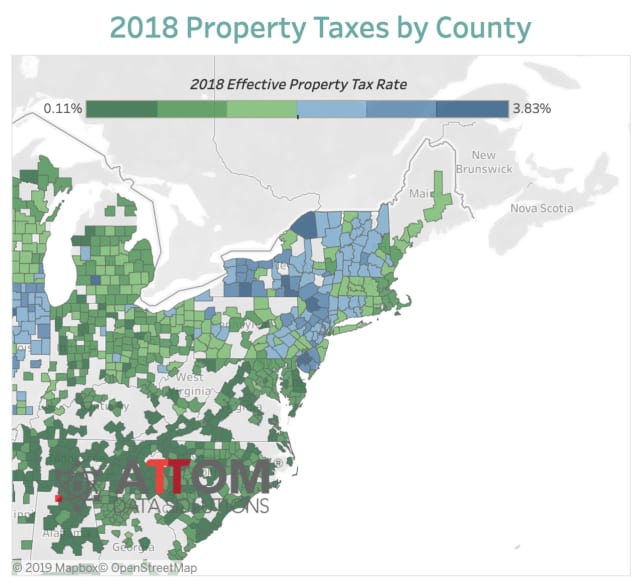

Upstate Ny Has Some Of The Highest Property Tax Rates In The Nation

Haves And Have Nots County Property Taxes Provided 2 5 Billion In Local Health And Social Service Funding But It Was Unevenly Distributed The Center For Community Solutions

Putnam County Ny Property Tax Search And Records Propertyshark

Haves And Have Nots County Property Taxes Provided 2 5 Billion In Local Health And Social Service Funding But It Was Unevenly Distributed The Center For Community Solutions

Putnam Passes 10 Cent Property Tax Increase Ucbj Upper Cumberland Business Journal

Taxes The Treasurer Village Of Pinckney

2022 Best Places To Buy A House In Putnam County Ny Niche

Ada County Treasurer S Office Home Facebook

Putnam County Tax Assessor S Office

Sales Tax Information Bureau County Government Princeton Il

Local Income Tax Notebook How Monroe County Stacks Up Statewide The B Square

April S Marketwatch Is In Look At That Interest Rate Indiana Marketing Things To Sell

Cleveland County Assessor Rolls Out New Website News Normantranscript Com

Another Warwick Home Sold Video Catskill New York Home Selling Tips Hudson Valley

These Hudson Valley Counties Have Highest Property Tax Rates In Nation New Study Says Ramapo Daily Voice

Upstate Ny Has Some Of The Highest Property Tax Rates In The Nation